After being shelved for eight consecutive months, dozens of new video games have received the green light to be released on the Chinese market in April. This milestone marks the end of a drawn-out, government-ordered freeze on new video games that began in August 2021.

On the evening of April 11, China’s General Administration of Press and Publication (NPPA) made an unexpected announcement: 45 new video games by Chinese studios were named as recipients of new operating licenses.

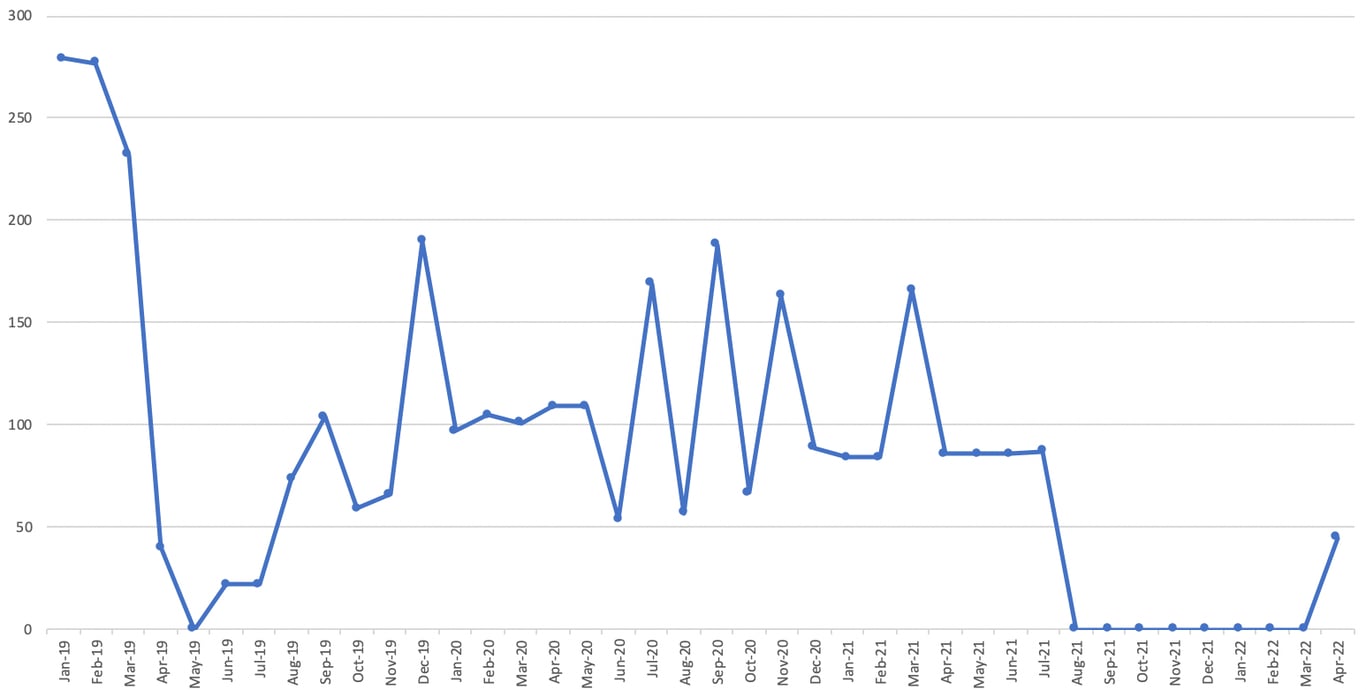

The administration approved 1,365 games in 2019 and 1,308 in 2020, but these figures were practically halved in 2021, with only 679 licenses being issued.

Monthly figures showing new video game approvals between 2019 and 2022. Data from NPPA; infographic via RADII

The government has come down hard on the video game industry and consumers in recent years. The Clear and Bright Campaign, which scours China’s internet for ‘chaotic phenomenon,’ including teen celebrity worship, kid influencers, and fake news, also aims to reduce gaming addiction amongst minors.

In August 2021, around the same time new video games ran into more challenging approval procedures, the NPPA announced rules limiting minors’ time playing online video games to 8-9 PM on Fridays, Saturdays, Sundays, and public holidays.

So, you’re probably wondering: How have game developers and studios weathered the past eight months? To learn more, RADII spoke with Leslie Huang, a Bilibili marketing specialist who works explicitly on video game projects, to gain insight into the drawn-out freeze in China’s gaming industry, the biggest in the world.

RADII: How did you and your team react to the good news?

Leslie Huang: An NPPA document indicating the approval of a new mobile game first circulated within our WeChat group last night (April 11). But we thought it was yet another bogus document — such rumors of resumption have been circulating over the past eight months.

Then more documents were released, and the media broke the news saying that more than 40 new games had been approved. We were in total disbelief before the thrill of excitement sunk in.

Can you briefly walk us through the process of getting a video game approved in China?

LH: Application processes for games developed by domestic firms and titles acquired from overseas companies are different. I’ll focus on the former. Basically, to start, the initial proposal and demo have to be internally approved by multiple departments. Then we need to compile all the required paperwork — gameplay, R&D information, marketing plans, etcetera — in a folder to be submitted to the NPPA.

While waiting for the NPPA’s decision, we start running close beta tests on a pool of people drawn from our target audience. Once we have received the green light from the NPPA, we move forward with open beta tests, and nail down our marketing and release plan.

Before the green light, however, there is often a lot of back-and-forth with the NPPA, which will suggest adjustments. The entire process usually takes a year.

How has the eight-month freeze affected the industry?

LH: Many small and independent studios bore the brunt [of the freeze] and went bankrupt or merged with gaming giants.

I can clearly recall one work conversation with my supervisor that took place in a rideshare. The driver overheard that we work at Bilibili’s game department. For the rest of the ride, he spared no effort at trying to connect us with his friend — an independent game developer who had trouble getting an NPPA license.

He wanted us to help his friend by purchasing the game he developed. Anyway, [the ban] was hard on everyone.

How did local studios survive? By pivoting toward other means of licensing or going overseas?

LH: Yes, many of us tried the strategy of distributing games overseas.

It was possible to work on a few projects to distribute overseas games to other countries. But let’s say we acquired the rights to distribute a U.S.-made game in East Asia: Being based in China, it would be difficult for us to understand audiences in other East Asian nations, like, say, Japan or Korea. For this reason, our company has been hiring staff with international backgrounds, especially from non-English-speaking foreign countries.

At the same time, we tried some ‘underground’ means to distribute the non-licensed games through the Chinese version of Steam. However, we weren’t allowed to spread the word on social media channels such as Weibo. We had to move very covertly with marketing.

Speaking of marketing, how did the ban impact the promotion of video games?

LH: It was a massive blow to game marketing, as marketing is critical to any new product, isn’t it? The freeze was immediately followed by other stringent measures that limited the potential promotion of unauthorized games: No livestreaming or celebrity-endorsed advertisements were allowed.

Meanwhile, game marketing agencies competed fiercely to snatch the limited NPPA-licensed accounts. In short, we didn’t have many projects to work on, which, in turn, signified layoffs.

What does the lifting of the ban mean for the industry? And, do you know the real reason behind the sudden policy change?

LH: We’re finally out of a stagnant and lifeless condition — it is such a relief. We can start to envision more projects for the future. Nevertheless, many of us are still closely monitoring the NPPA’s future moves, because it lifted the ban out of the blue.

To be honest, we don’t expect things to return to the norm preceding the freeze. We suspect that as many cities are experiencing lockdowns due to Covid, NPPA decision-makers were like, “Okay, they need video games to play at home.” Also, the gaming industry is an integral part of the digital economy and can bump up GDP.

Cover image via Depositphotos